Quick Answer: North Carolina offers a few different types of sales tax returns. This blog gives instructions on how to file and pay sales tax in North Carolina using the E-500 Sales and Use Tax Return, a return commonly used by out-of-state sellers. North Carolina requires payment at the time of filing so have your payment information ready when you file.

Once you have an active sales tax permit in North Carolina, you will need to begin filing sales tax returns. Not sure if you need a permit in North Carolina? No problem. Check out our blog, Do You Need to Get a Sales Tax Permit in North Carolina ?

Also, If you would rather ask someone else to handle your North Carolina filings, our team at TaxValet can handle that for you with our Done-for-You Sales Tax Service . We specialize in eliminating the stress and hassle of sales tax.

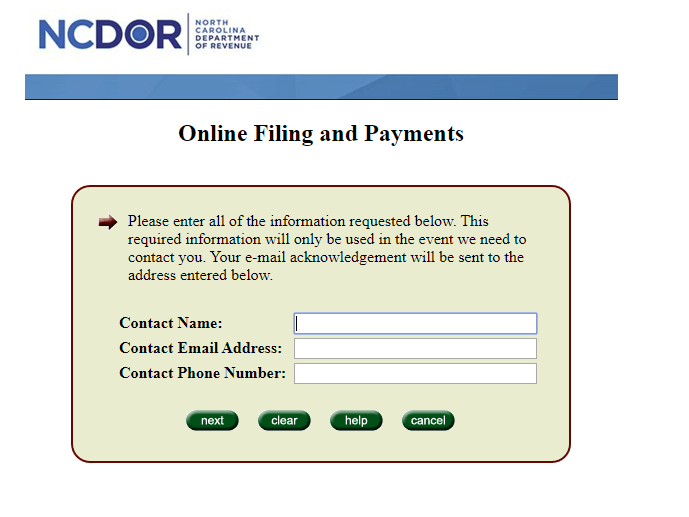

Step 1 : The first step in filing your North Carolina sales tax return is to log into the website here https://eservices.dor.nc.gov/sau/contact.jsp .

If you do not have a username and password then your first step is setting that up. Your username and password are generally created when you submit registration paperwork for a sales tax permit.

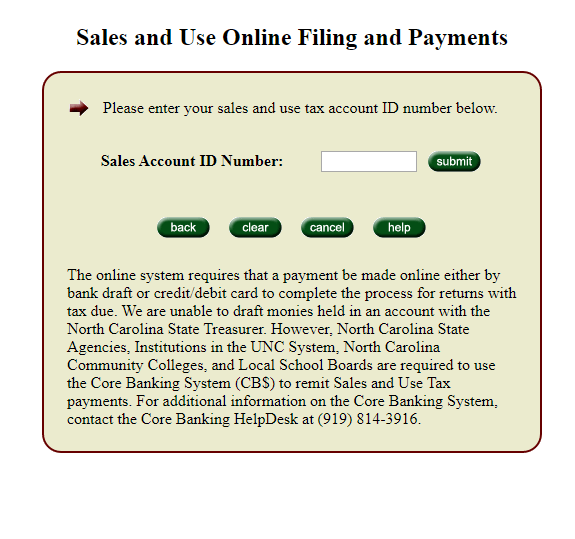

Step 2: Enter your Sales Account ID Number (SID) and verify your business information. If everything looks correct, select “ Next ”.

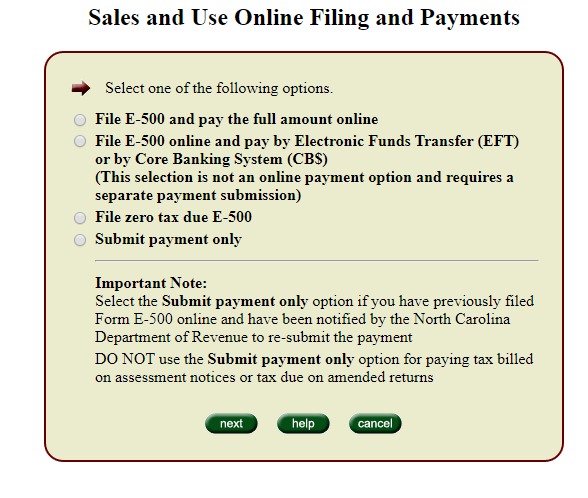

Step 3: Select the return you want to file (in this example we are filing E-500) as well as the method you intend to pay the return with.

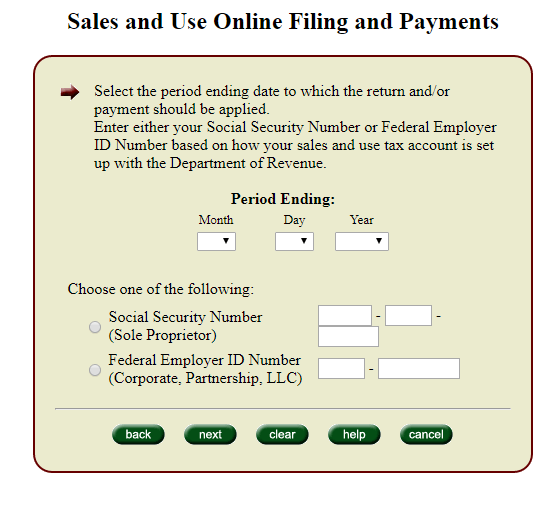

Step 4: Enter the period you are filing for and your Social Security number or Federal Employer ID (FEIN) number.

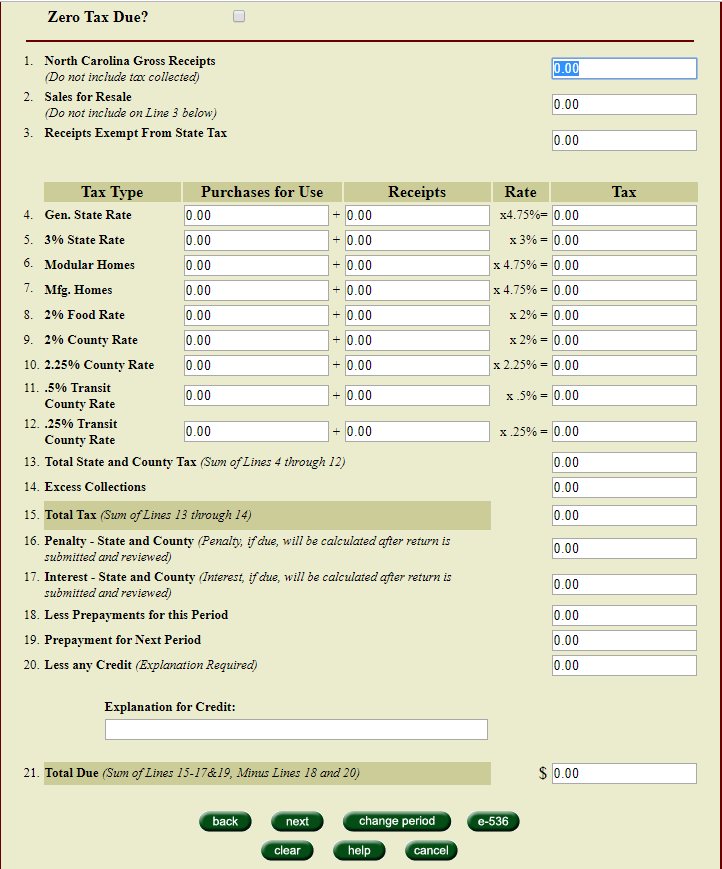

Step 5: Now is when things get interesting. This is where you get to enter your sales information. Line 1 is your gross sales (do not include tax collected). Line 2 is for any resale amounts. Line 3 is for any other exempt sales. Lines 4 through 13 help break down your taxable sales. Don’t forget to add any taxable purchases, if you had any.

If you have questions on which line you should use there is a link at the top of the page with line by line instructions.

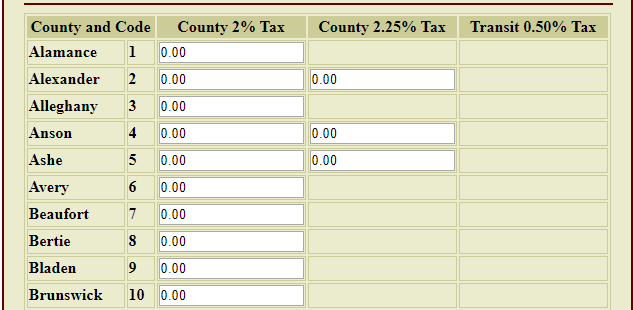

Step 6: Now it is time to enter jurisdiction information on form E-536 (this is just a specific part of the E-500 form). Start by entering your tax for each county. The sum should equal the corresponding amount of county tax on your sales and use tax return. The 2% Food Tax should be entered at the bottom of this page.

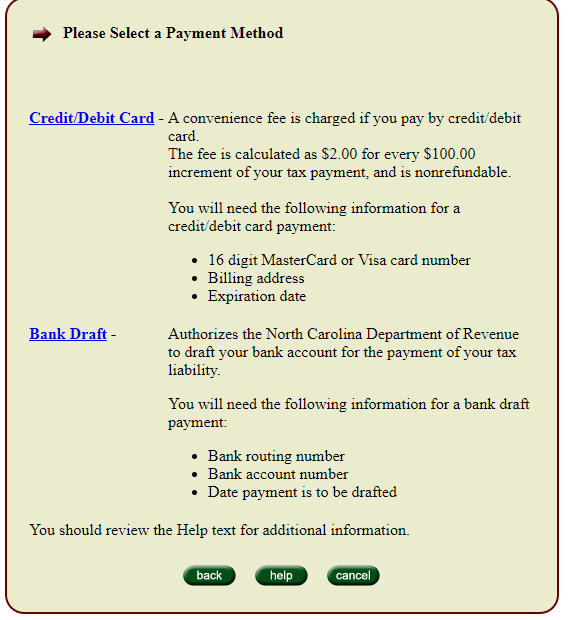

Step 7: You must make a payment at the time of filing for North Carolina. Select the payment type you want to use and follow the instructions to enter your payment information.

Step 8: Do NOT forget to print and/or save a copy of your return and payment. North Carolina’s website is very restricted on what you can do and I have not found a way to print the return after it has been submitted.

Hooray! You have filed your sales tax return.

You may make a payment on the sales and use online filing and payments page, but only if you have previously filed Form E-500 online and have been notified by the North Carolina Department of Revenue to re-submit the payment. DO NOT use the Submit payment only option for paying tax billed on assessment notices or tax due on amended returns. Instead, you can mail payments to: North Carolina Department of Revenue Post Office Box 25000 Raleigh, NC 27640-0640

As a final step, it is always a good idea to verify that the correct amount of funds were withdrawn from your bank account on the correct day.

If you are stuck or have questions, you can contact the state at (877) 252-3052 between the hours of 7:00 am and 5:00 pm, EST Monday through Friday. But if you are looking for a team of experts to handle your sales tax returns for you each month, you should check out our Done-for-You Sales Tax Service . Feel free to contact us if you’re interested in becoming a client!